Al.ly

Al.ly is another very popular URL Shortening Service for earning money on short links without investing any single $. Al.ly will pay from $1 to $10 per 1000 views depending upon the different regions. Minimum withdrawal is only $1, and it pays through PayPal, Payoneer, or Payza. So, you have to earn only $1.00 to become eligible to get paid using Al.ly URL Shortening Service.

Besides the short links, Al.ly also runs a referral program wherein you can earn 20% commission on referrals for a lifetime. The referral program is one of the best ways to earn even more money with your short links. Al.ly offers three different account subscriptions, including free option as well as premium options with advanced features.Fas.li

Although Fas.li is relatively new URL Shortener Service, it has made its name and is regarded as one of the most trusted URL Shortener Company. It provides a wonderful opportunity for earning money online without spending even a single $. You can expect to earn up to $15 per 1000 views through Fas.li.

You can start by registering a free account on Fas.li, shrink your important URLs, and share it with your fans and friends in blogs, forums, social media, etc. The minimum payout is $5, and the payment is made through PayPal or Payza on 1st or 15th of each month.

Fas.li also run a referral program wherein you can earn a flat commission of 20% by referring for a lifetime. Moreover, Fas.li is not banned in anywhere so you can earn from those places where other URL Shortening Services are banned.BIT-URL

It is a new URL shortener website.Its CPM rate is good.You can sign up for free and shorten your URL and that shortener URL can be paste on your websites, blogs or social media networking sites.bit-url.com pays $8.10 for 1000 views.

You can withdraw your amount when it reaches $3.bit-url.com offers 20% commission for your referral link.Payment methods are PayPal, Payza, Payeer, and Flexy etc.- The payout for 1000 views-$8.10

- Minimum payout-$3

- Referral commission-20%

- Payment methods- Paypal, Payza, and Payeer

- Payment time-daily

Ouo.io

Ouo.io is one of the fastest growing URL Shortener Service. Its pretty domain name is helpful in generating more clicks than other URL Shortener Services, and so you get a good opportunity for earning more money out of your shortened link. Ouo.io comes with several advanced features as well as customization options.

With Ouo.io you can earn up to $8 per 1000 views. It also counts multiple views from same IP or person. With Ouo.io is becomes easy to earn money using its URL Shortener Service. The minimum payout is $5. Your earnings are automatically credited to your PayPal or Payoneer account on 1st or 15th of the month.- Payout for every 1000 views-$5

- Minimum payout-$5

- Referral commission-20%

- Payout time-1st and 15th date of the month

- Payout options-PayPal and Payza

Shrinkearn.com

Shrinkearn.com is one of the best and most trusted sites from our 30 highest paying URL shortener list.It is also one of the old URL shortener sites.You just have to sign up in the shrinkearn.com website. Then you can shorten your URL and can put that URL to your website, blog or any other social networking sites.

Whenever any visitor will click your shortener URL link you will get some amount for that click.The payout rates from Shrinkearn.com is very high.You can earn $20 for 1000 views.Visitor has to stay only for 5 seconds on the publisher site and then can click on skip button to go to the requesting site.- The payout for 1000 views- up to $20

- Minimum payout-$1

- Referral commission-25%

- Payment methods-PayPal

- Payment date-10th day of every month

Adf.ly

Adf.ly is the oldest and one of the most trusted URL Shortener Service for making money by shrinking your links. Adf.ly provides you an opportunity to earn up to $5 per 1000 views. However, the earnings depend upon the demographics of users who go on to click the shortened link by Adf.ly.

It offers a very comprehensive reporting system for tracking the performance of your each shortened URL. The minimum payout is kept low, and it is $5. It pays on 10th of every month. You can receive your earnings via PayPal, Payza, or AlertPay. Adf.ly also runs a referral program wherein you can earn a flat 20% commission for each referral for a lifetime.Oke.io

Oke.io provides you an opportunity to earn money online by shortening URLs. Oke.io is a very friendly URL Shortener Service as it enables you to earn money by shortening and sharing URLs easily.

Oke.io can pay you anywhere from $5 to $10 for your US, UK, and Canada visitors, whereas for the rest of the world the CPM will not be less than $2. You can sign up by using your email. The minimum payout is $5, and the payment is made via PayPal.- The payout for 1000 views-$7

- Minimum payout-$5

- Referral commission-20%

- Payout options-PayPal, Payza, Bitcoin and Skrill

- Payment time-daily

Bc.vc

Bc.vc is another great URL Shortener Site. It provides you an opportunity to earn $4 to $10 per 1000 visits on your Shortened URL. The minimum withdrawal is $10, and the payment method used PayPal or Payoneer.

Payments are made automatically on every seven days for earnings higher than $10.00. It also runs a referral system wherein the rate of referral earning is 10%.- The payout for 1000 views-$10

- Minimum payout -$10

- Referral commission-10%

- Payment method -Paypal

- Payment time-daily

Dwindly

Dwindly is one of the best URL Shorten to earn money online. It offers the opportunity to earn money for every person that views links you have created.

Its working is simple. You need to create an account and then shorten any URLs with a click of a button. Go on to share your shortened URLs on the internet, including social media, YouTube, blogs, and websites. And finally, earn when any person clicks on your shortened URL.

They offer the best environment to you for earning money from home. They have even come up with a referral system where you can invite people to Dwindly and earn as much as 20% of their income.

It has built-in a unique system wherein you get the opportunity to increase your daily profits when you analyze your top traffic sources and detailed stats.

Best of all, you get the highest payout rates. The scripts and the APIs allow you to earn through your websites efficiently.

Last but not the least you get payments on time within four days.Linkshrink

Linkshrink URL Shortener Service provides you an opportunity to monetize links that you go on the Internet. Linkshrink comes as one of the most trusted URL Shortener Service. It provides an advanced reporting system so that you can easily track the performance of your shortened links. You can use Linkshrink to shorten your long URL. With Linkshrink, you can earn anywhere from $3 to $10 per 1000 views.

Linkshrink provides lots of customization options. For example, you can change URL or have some custom message other than the usual "Skip this Ad" message for increasing your link clicks and views on the ad. Linkshrink also offers a flat $25 commission on your referrals. The minimum payout with Linkshrink is $5. It pays you through PayPal, Payza, or Bitcoin.Short.am

Short.am provides a big opportunity for earning money by shortening links. It is a rapidly growing URL Shortening Service. You simply need to sign up and start shrinking links. You can share the shortened links across the web, on your webpage, Twitter, Facebook, and more. Short.am provides detailed statistics and easy-to-use API.

It even provides add-ons and plugins so that you can monetize your WordPress site. The minimum payout is $5 before you will be paid. It pays users via PayPal or Payoneer. It has the best market payout rates, offering unparalleled revenue. Short.am also run a referral program wherein you can earn 20% extra commission for life.Short.pe

Short.pe is one of the most trusted sites from our top 30 highest paying URL shorteners.It pays on time.intrusting thing is that same visitor can click on your shorten link multiple times.You can earn by sign up and shorten your long URL.You just have to paste that URL to somewhere.

You can paste it into your website, blog, or social media networking sites.They offer $5 for every 1000 views.You can also earn 20% referral commission from this site.Their minimum payout amount is only $1.You can withdraw from Paypal, Payza, and Payoneer.- The payout for 1000 views-$5

- Minimum payout-$1

- Referral commission-20% for lifetime

- Payment methods-Paypal, Payza, and Payoneer

- Payment time-on daily basis

LINK.TL

LINK.TL is one of the best and highest URL shortener website.It pays up to $16 for every 1000 views.You just have to sign up for free.You can earn by shortening your long URL into short and you can paste that URL into your website, blogs or social media networking sites, like facebook, twitter, and google plus etc.

One of the best thing about this site is its referral system.They offer 10% referral commission.You can withdraw your amount when it reaches $5.- Payout for 1000 views-$16

- Minimum payout-$5

- Referral commission-10%

- Payout methods-Paypal, Payza, and Skrill

- Payment time-daily basis

Clk.sh

Clk.sh is a newly launched trusted link shortener network, it is a sister site of shrinkearn.com. I like ClkSh because it accepts multiple views from same visitors. If any one searching for Top and best url shortener service then i recommend this url shortener to our users. Clk.sh accepts advertisers and publishers from all over the world. It offers an opportunity to all its publishers to earn money and advertisers will get their targeted audience for cheapest rate. While writing ClkSh was offering up to $8 per 1000 visits and its minimum cpm rate is $1.4. Like Shrinkearn, Shorte.st url shorteners Clk.sh also offers some best features to all its users, including Good customer support, multiple views counting, decent cpm rates, good referral rate, multiple tools, quick payments etc. ClkSh offers 30% referral commission to its publishers. It uses 6 payment methods to all its users.- Payout for 1000 Views: Upto $8

- Minimum Withdrawal: $5

- Referral Commission: 30%

- Payment Methods: PayPal, Payza, Skrill etc.

- Payment Time: Daily

CPMlink

CPMlink is one of the most legit URL shortener sites.You can sign up for free.It works like other shortener sites.You just have to shorten your link and paste that link into the internet.When someone will click on your link.

You will get some amount of that click.It pays around $5 for every 1000 views.They offer 10% commission as the referral program.You can withdraw your amount when it reaches $5.The payment is then sent to your PayPal, Payza or Skrill account daily after requesting it.- The payout for 1000 views-$5

- Minimum payout-$5

- Referral commission-10%

- Payment methods-Paypal, Payza, and Skrill

- Payment time-daily

Linkrex.net

Linkrex.net is one of the new URL shortener sites.You can trust it.It is paying and is a legit site.It offers high CPM rate.You can earn money by sing up to linkrex and shorten your URL link and paste it anywhere.You can paste it in your website or blog.You can paste it into social media networking sites like facebook, twitter or google plus etc.

You will be paid whenever anyone will click on that shorten a link.You can earn more than $15 for 1000 views.You can withdraw your amount when it reaches $5.Another way of earning from this site is to refer other people.You can earn 25% as a referral commission.- The payout for 1000 views-$14

- Minimum payout-$5

- Referral commission-25%

- Payment Options-Paypal,Bitcoin,Skrill and Paytm,etc

- Payment time-daily

Linkbucks

Linkbucks is another best and one of the most popular sites for shortening URLs and earning money. It boasts of high Google Page Rank as well as very high Alexa rankings. Linkbucks is paying $0.5 to $7 per 1000 views, and it depends on country to country.

The minimum payout is $10, and payment method is PayPal. It also provides the opportunity of referral earnings wherein you can earn 20% commission for a lifetime. Linkbucks runs advertising programs as well.- The payout for 1000 views-$3-9

- Minimum payout-$10

- Referral commission-20%

- Payment options-PayPal,Payza,and Payoneer

- Payment-on the daily basis

Cut-win

Cut-win is a new URL shortener website.It is paying at the time and you can trust it.You just have to sign up for an account and then you can shorten your URL and put that URL anywhere.You can paste it into your site, blog or even social media networking sites.It pays high CPM rate.

You can earn $10 for 1000 views.You can earn 22% commission through the referral system.The most important thing is that you can withdraw your amount when it reaches $1.- The payout for 1000 views-$10

- Minimum payout-$1

- Referral commission-22%

- Payment methods-PayPal, Payza, Bitcoin, Skrill, Western Union and Moneygram etc.

- Payment time-daily

Wi.cr

Wi.cr is also one of the 30 highest paying URL sites.You can earn through shortening links.When someone will click on your link.You will be paid.They offer $7 for 1000 views.Minimum payout is $5.

You can earn through its referral program.When someone will open the account through your link you will get 10% commission.Payment option is PayPal.- Payout for 1000 views-$7

- Minimum payout-$5

- Referral commission-10%

- Payout method-Paypal

- Payout time-daily

Friday 29 March 2019

19 Best URL Shortener to Earn Money

Building A Model For Retirement Savings In Python

It's easy to find investment advice. It's a little less easy to find good investment advice, but still pretty easy. We are awash in advice on saving for retirement, with hundreds of books and hundreds of thousands of articles written on the subject. It is studied relentlessly, and the general consensus is that it's best to start early, make regular contributions, stick it all in low-fee index funds, and ignore it. I'm not going to dispute that, but I do want to better understand why it works so well. As programmers we don't have to simply take these studies at their word. The data is readily available, and we can explore retirement savings strategies ourselves by writing models in code. Let's take a look at how to build up a model in Python to see how much we can save over the course of a career.

Disclaimer: I am not a financial adviser, so this article should not be taken as financial advice. It is merely an exploration of a model of retirement savings for the purpose of learning and understanding how savings could grow over time.

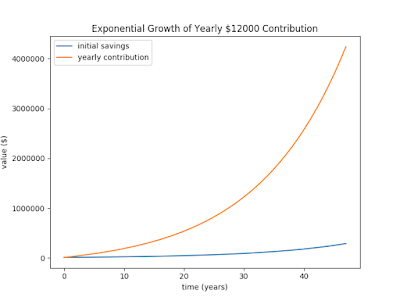

We'll start with a very simple model to get things started. How about we put in an initial investment of $12,000 at 20 years old and let it grow until retirement at 67. How do we have $12,000 at 20? Maybe it's a gift from a rich aunt and uncle or we saved like crazy during a summer internship between college semesters. Somehow we came up with it. Why $12,000? Because there's 12 months in a year, and that seemed nice. What does it look like after 48 years? Here's a simple exponential model to give us an estimate:

Our little retirement fund reaches nearly $290,000 by the end of our career. That's not too bad considering it was just a single contribution from before we could legally drink, but it's probably not enough to last through retirement, what with inflation and health care and all to consider. What happens if we manage to pull together $12,000 every year and contribute to our nest egg? It's going to be tough in the beginning, but it'll get easier. Plus, those early years are the most important.

The equation for regular contributions to an exponentially growing investment is a little trickier, but other people have already figured it out so we'll just use what they did. The equation is

value = P*ry + C*(ry - 1)/(r - 1)

Where P is the principle investment, C is the yearly contribution, r is the rate of return in the form of 1.0x for x%, and y is the number of years to invest. Plugging that equation into our Python model gives the following code:

Whoa! After all of that time contributing to saving, we end up with over $4.2 million. That's some serious retirement funds. Now we're really starting to see the power of savings rates with regular contributions. It's not just important to save early, but to save regularly. However, this model is still relatively divorced from the real world. In the real world, we're never going to see a consistent 7% return year after year. Some years it will be less, and some years it will be a lot more. What happens to our plan of consistent yearly contributions when we know that some years we're going to be dropping in a chunk of cash right near the peak of the market?

To answer that question, we can look at historical prices. We used to be able to get a nice, long history of prices for the main market indexes—the Dow Jones, NASDAQ, and S&P500—quite easily from Yahoo and Google APIs, but it seems those sources have been shut down in the last couple years. We can still manually download .csv files of historical prices at finance.yahoo.com, for example the NASDAQ daily prices all the way back to its start in 1971 can be downloaded here. It's not as fun as using an API, but we can easily read this file into our Python script using Pandas read_csv() function, and offset the date so that we can look at years since the beginning of the index:

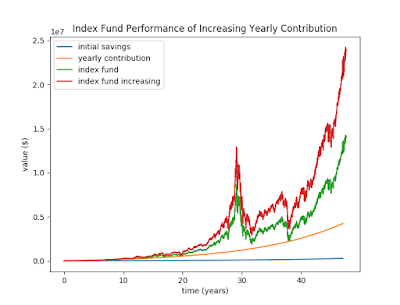

After the initial investment shares, we can populate a Series that matches the length of our investment period with updated shares as we make additional contributions each year. We loop through the historical prices, and each time we cross into a new year, we add more shares with the next contribution at the price that the index is at that time. Since the first day of trading in the new year doesn't necessarily land on January 2nd, the if condition shows a simple way to detect the first trading day of the new year for each year. Here's how our hypothetical investments did over the last 48 years sitting in the NASDAQ:

Yikes! Not only did we best the simple exponential model, but we blew it away with about $14M in savings by the end. The investments in the fund also never dropped below the conservative 7% estimated rate of return, even during the dotcom crash and the Great Recession. (Okay, it did a little in the beginning, but you can't really see that here.) Why did we do so much better? Partly it's because the NASDAQ has performed better than a 7% return, on average, getting about 9.5% returns over the last 48 years. That doesn't fully explain the better performance, though, because plugging the simple model with 9.5% returns would result in $9.7M by the time we retire.

The other $4.3M in gains comes from all of the contributions that happened while the market was down. This is by far the best time to buy because the market recovers more quickly after it's been down, and the gains of those new contributions are juiced along with the recovering shares that were purchased at higher prices. In the end, the gains are more than they would have been with a smooth rate of return. However, when the market is down, it's also the most difficult time to buy, and it's extremely hard (some say impossible) to predict the market. It's these characteristics that make it so important to stick to the plan of investing early and regularly.

We now have a more accurate hypothetical investment scenario, but we can do even better. So far we've assumed that we're investing the same amount every year. That's a fine goal, but it's going to get really easy to achieve as we get raises over the years. Hopefully we won't be making the same salary at 45 that we were at 25, so let's try to model that by building in a yearly increase to the contributions. Now, we have to make a few assumptions in light of a ton of potential contributing factors. Over the years expenses will likely increase as we buy a house, start a family, and generally start enjoying the fruits of our labor more. Be careful, though. If you find your expenses increasing faster than your salary, it's going to become more difficult to meet your savings goals.

Let's assume that's not the case, and you find a way to moderately increase your expenses over time. Most years it should be fairly straightforward to live on a budget pretty close to the previous year. Sometimes bigger expenses, or step-ups in spending happen, but step-ups in income also happen. Getting married or otherwise becoming a dual-income household is generally a big step-up. Promotions will also give a good boost to income. These positive things combined with a steady budget can result in most of the increased income being available for savings. Since savings is only a percentage of your total income, this means a big increase in savings. For example, suppose you're saving 20% of your income, and you get a 5% raise. If you sock all of that raise into savings, that equates to a 25% increase in savings. Since step-ups like that doesn't happen every year, let's keep things simple and assume a 5% increase in savings every year. That results in the following calculations:

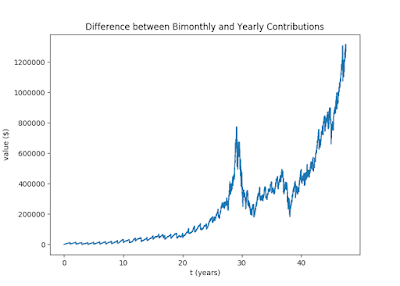

Now we're looking at about $24M available in retirement! This keeps getting better. Another nice thing about this investment is that it doesn't have to end at retirement. There are tons of options for taking out some funds to safely live off of and continue investing the rest, letting it grow further during retirement. Making donations to worthy causes is also a definite possibility here. You know, spread the wealth that you have been so blessed with. Of course, we have many, many years ahead of us before this nest egg becomes a reality, so let's focus on the model we're exploring. We can look at another inaccuracy that's been in the model for a while, namely that we're investing one big chunk of money each year. It should be better to invest smaller amounts more often, so let's split the yearly contribution into bimonthly paycheck contributions, 24 total for each year.

Huh, it's a little more difficult to see any difference with the paycheck contribution approach. This was actually a bit surprising because I expected more of an increase due to investing earlier and more frequently. To see how much of a difference there really is, we can plot the difference between the paycheck contributions and the yearly contributions:

It turns out that we make an extra $1.3M over the full 48 years, but it takes some time to build up and is never more than about 5% of the total investment. The accumulation of exponential gains over the entire investment period is much more important than the small additional gains we get by spreading the yearly contributions over the course of each year. Even so, it's probably best to plug that money into the retirement fund as soon as it's available, just so that it'll be saved instead of spent. The small extra gains to be had from investing it a little bit earlier is a little extra bonus.

One thing we haven't modeled here is what happens if we could optimize our investment performance through buying and selling at opportune times, otherwise known as timing the market. This is a really bad idea for at least three reasons. First—and the most often cited reason—it's extremely difficult to time the market successfully, and do it consistently. The day-to-day movements in the market are so noisy that it's anyone's guess (and it really is a guess) which way the market is going to move at any given time. Even if you have a 50-50 shot of getting it right on any given trade, you're not going to get ahead at all by doing this. More likely, you'll fall behind because of the next reason.

Second, if you're selling a lot, it's probably short sales, and the taxes on those sales are going to erode your realized gains. That means you have to be doing that much better on your returns, just to break even with keeping your money parked in a fund. If the gains are going to be taxed at a marginal rate of 25%, and you're managing to make returns of 11%, then after taxes your gains are actually only 8.25%. That's less than the 9.5% average gains of the NASDAQ. You would actually need to get returns of 12.7% just to break even with leaving your money alone. As your investments grow, it gets even harder to beat the market because the larger gains push you into a higher tax bracket. At the 35% bracket you have to achieve gains of 14.6% just to break even. Granted, you could limit this market timing to tax-advantaged accounts, but that will become a smaller and smaller percentage of your total investments if you keep increasing your contributions. The smaller fraction of tax-advantaged funds will matter less and less over time. Plus, refer back to the first reason, or risk watching your tax-advantaged retirement accounts dwindle instead of grow.

Third, if you stick to index funds, as you should, you are limited in how soon you can sell after buying a fund. Depending on how you're investing, this limit can be 30 to 90 days from your last contribution. This limitation makes timing the market all the more difficult and fraught with risk. But that's a feature, not a bug. It discourages trying to do something you just shouldn't do. If you really want to try being a day trader, you're going to have to go with individual stocks, and that path carries its own set of bigger risks and an even bigger time commitment. Besides, look at those graphs of our investments. Nearly all of the downturns in the market were in the noise, save the dotcom crash and the Great Recession, and the latter doesn't even look like that big of a deal in the graph considering the recovery afterward. The bottom line is, you shouldn't sell. That is, unless you're ready to sell.

The one case where it's probably okay to sell early is if we've already overshot our long-term goals. Take a look back at the last graph. At the peak of the dotcom boom, before the bust, the model is showing investments of nearly $13.7M in the 29th year. If our goal was $10M or less by retirement, then it would be perfectly fine to sell off a significant amount of that position, pay the taxes on the long-term gains, and sink it into a more stable investment for safe-keeping. Or we may even decide to retire early! When the market crashes and the index fund is cheap again, we may even decide to get back in and benefit from the recovery. The point is that selling to get out of the market and then buying later to get back in had nothing to do with trying to predict the dotcom boom and bust. We were simply acting on the fact that our goals were met, and then we saw a prime opportunity that we couldn't pass up. Suffice it to say, these situations don't come up very often. In this 48-year span it only happened once, arguably twice with the housing crash, so it should not be a strategy to depend on happening frequently.

We've learned a great deal from this set of simple models. It's surprising how little code is needed to get a clear picture of some solid investment strategies. It's so obvious that it's great to start early and let the wonders of exponential growth work for you. Investing often—at least once a year—makes a huge difference in the value of your nest egg. Continuing to increase the contributions over time also maximizes your savings potential, and even adds significantly to the accumulated savings in later years. The best part is how easy it is to experiment once we have a working model. We can twiddle with the parameters and see how changes affect the outcome. Through that experimentation, we can get more comfortable with why certain recommendations make good sense, and better understand which investment strategy will help us reach our retirement goals with minimal fuss.

Disclaimer: I am not a financial adviser, so this article should not be taken as financial advice. It is merely an exploration of a model of retirement savings for the purpose of learning and understanding how savings could grow over time.

We'll start with a very simple model to get things started. How about we put in an initial investment of $12,000 at 20 years old and let it grow until retirement at 67. How do we have $12,000 at 20? Maybe it's a gift from a rich aunt and uncle or we saved like crazy during a summer internship between college semesters. Somehow we came up with it. Why $12,000? Because there's 12 months in a year, and that seemed nice. What does it look like after 48 years? Here's a simple exponential model to give us an estimate:

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

rate = 1.07

years_saving = 48

initial_savings = 12000

model = pd.DataFrame({'t': range(years_saving)})

model['simple_exp'] = [initial_savings*rate**year for year in model.t]

plt.figure()

plt.plot(model.t, model.simple_exp)

plt.title('Exponential Growth of Initial Savings')

plt.xlabel('time (years)')

plt.ylabel('value ($)')

Our little retirement fund reaches nearly $290,000 by the end of our career. That's not too bad considering it was just a single contribution from before we could legally drink, but it's probably not enough to last through retirement, what with inflation and health care and all to consider. What happens if we manage to pull together $12,000 every year and contribute to our nest egg? It's going to be tough in the beginning, but it'll get easier. Plus, those early years are the most important.

The equation for regular contributions to an exponentially growing investment is a little trickier, but other people have already figured it out so we'll just use what they did. The equation is

value = P*ry + C*(ry - 1)/(r - 1)

Where P is the principle investment, C is the yearly contribution, r is the rate of return in the form of 1.0x for x%, and y is the number of years to invest. Plugging that equation into our Python model gives the following code:

yearly_contribution = 12000

model['yearly_invest'] = model['simple_exp'] + [yearly_contribution*(rate**year - 1)/(rate-1) for year in model.t]

plt.plot(model.t, model.yearly_invest)

plt.title('Exponential Growth of Yearly $' + str(yearly_contribution) + ' Contribution')

plt.legend(['initial savings', 'yearly contribution'])

To answer that question, we can look at historical prices. We used to be able to get a nice, long history of prices for the main market indexes—the Dow Jones, NASDAQ, and S&P500—quite easily from Yahoo and Google APIs, but it seems those sources have been shut down in the last couple years. We can still manually download .csv files of historical prices at finance.yahoo.com, for example the NASDAQ daily prices all the way back to its start in 1971 can be downloaded here. It's not as fun as using an API, but we can easily read this file into our Python script using Pandas read_csv() function, and offset the date so that we can look at years since the beginning of the index:

ixic = pd.read_csv('ixic.csv')

ixic['Date'] = pd.to_datetime(ixic['Date'])

ixic['t'] = (ixic.Date - ixic.Date.min()) / np.timedelta64(1, 'Y')

shares = initial_savings / ixic.Close.iloc[0]

share_col = pd.Series(index=ixic.index)

for index, row in ixic.iterrows():

if row.t >= round(row.t) and ixic.t.iloc[index-1] < round(row.t):

shares += yearly_contribution / row.Close

share_col.iloc[index] = shares

ixic['shares'] = share_col

plt.plot(ixic.t, ixic.Close*ixic.shares)

plt.title('Index Fund Performance of Yearly $' + str(yearly_contribution) + ' Contribution')

plt.legend(['initial savings', 'yearly contribution', 'index fund'])

After the initial investment shares, we can populate a Series that matches the length of our investment period with updated shares as we make additional contributions each year. We loop through the historical prices, and each time we cross into a new year, we add more shares with the next contribution at the price that the index is at that time. Since the first day of trading in the new year doesn't necessarily land on January 2nd, the if condition shows a simple way to detect the first trading day of the new year for each year. Here's how our hypothetical investments did over the last 48 years sitting in the NASDAQ:

Yikes! Not only did we best the simple exponential model, but we blew it away with about $14M in savings by the end. The investments in the fund also never dropped below the conservative 7% estimated rate of return, even during the dotcom crash and the Great Recession. (Okay, it did a little in the beginning, but you can't really see that here.) Why did we do so much better? Partly it's because the NASDAQ has performed better than a 7% return, on average, getting about 9.5% returns over the last 48 years. That doesn't fully explain the better performance, though, because plugging the simple model with 9.5% returns would result in $9.7M by the time we retire.

The other $4.3M in gains comes from all of the contributions that happened while the market was down. This is by far the best time to buy because the market recovers more quickly after it's been down, and the gains of those new contributions are juiced along with the recovering shares that were purchased at higher prices. In the end, the gains are more than they would have been with a smooth rate of return. However, when the market is down, it's also the most difficult time to buy, and it's extremely hard (some say impossible) to predict the market. It's these characteristics that make it so important to stick to the plan of investing early and regularly.

We now have a more accurate hypothetical investment scenario, but we can do even better. So far we've assumed that we're investing the same amount every year. That's a fine goal, but it's going to get really easy to achieve as we get raises over the years. Hopefully we won't be making the same salary at 45 that we were at 25, so let's try to model that by building in a yearly increase to the contributions. Now, we have to make a few assumptions in light of a ton of potential contributing factors. Over the years expenses will likely increase as we buy a house, start a family, and generally start enjoying the fruits of our labor more. Be careful, though. If you find your expenses increasing faster than your salary, it's going to become more difficult to meet your savings goals.

Let's assume that's not the case, and you find a way to moderately increase your expenses over time. Most years it should be fairly straightforward to live on a budget pretty close to the previous year. Sometimes bigger expenses, or step-ups in spending happen, but step-ups in income also happen. Getting married or otherwise becoming a dual-income household is generally a big step-up. Promotions will also give a good boost to income. These positive things combined with a steady budget can result in most of the increased income being available for savings. Since savings is only a percentage of your total income, this means a big increase in savings. For example, suppose you're saving 20% of your income, and you get a 5% raise. If you sock all of that raise into savings, that equates to a 25% increase in savings. Since step-ups like that doesn't happen every year, let's keep things simple and assume a 5% increase in savings every year. That results in the following calculations:

shares = initial_savings / ixic.Close.iloc[0]

share_col = pd.Series(index=ixic.index)

for index, row in ixic.iterrows():

if row.t >= round(row.t) and ixic.t.iloc[index-1] < round(row.t):

shares += yearly_contribution / row.Close

yearly_contribution *= 1.05

share_col.iloc[index] = shares

ixic['shares_inc'] = share_col

plt.plot(ixic.t, ixic.Close*ixic.shares_inc)

plt.title('Index Fund Performance of Increasing Yearly Contribution')

plt.legend(['initial savings', 'yearly contribution', 'index fund', 'index fund increasing'])

Now we're looking at about $24M available in retirement! This keeps getting better. Another nice thing about this investment is that it doesn't have to end at retirement. There are tons of options for taking out some funds to safely live off of and continue investing the rest, letting it grow further during retirement. Making donations to worthy causes is also a definite possibility here. You know, spread the wealth that you have been so blessed with. Of course, we have many, many years ahead of us before this nest egg becomes a reality, so let's focus on the model we're exploring. We can look at another inaccuracy that's been in the model for a while, namely that we're investing one big chunk of money each year. It should be better to invest smaller amounts more often, so let's split the yearly contribution into bimonthly paycheck contributions, 24 total for each year.

payday_contribution = 500

shares = initial_savings / ixic.Close.iloc[0]

share_col = pd.Series(index=ixic.index)

prev_day = ixic.Date.iloc[0].day

for index, row in ixic.iterrows():

today = ixic.Date.iloc[index-1].day

if prev_day > 15 and today < 10 or prev_day < 15 and today >= 15:

shares += payday_contribution / row.Close

if row.t >= round(row.t) and ixic.t.iloc[index-1] < round(row.t):

payday_contribution *= 1.05

share_col.iloc[index] = shares

prev_day = today

ixic['shares_inc_payday'] = share_col

plt.plot(ixic.t, ixic.Close*ixic.shares_inc_payday)

plt.title('Index Fund Performance of Increasing Paycheck Contribution')

plt.legend(['initial savings', 'yearly contribution', 'index fund', 'index fund increasing', 'index fund payday'])

Huh, it's a little more difficult to see any difference with the paycheck contribution approach. This was actually a bit surprising because I expected more of an increase due to investing earlier and more frequently. To see how much of a difference there really is, we can plot the difference between the paycheck contributions and the yearly contributions:

One thing we haven't modeled here is what happens if we could optimize our investment performance through buying and selling at opportune times, otherwise known as timing the market. This is a really bad idea for at least three reasons. First—and the most often cited reason—it's extremely difficult to time the market successfully, and do it consistently. The day-to-day movements in the market are so noisy that it's anyone's guess (and it really is a guess) which way the market is going to move at any given time. Even if you have a 50-50 shot of getting it right on any given trade, you're not going to get ahead at all by doing this. More likely, you'll fall behind because of the next reason.

Second, if you're selling a lot, it's probably short sales, and the taxes on those sales are going to erode your realized gains. That means you have to be doing that much better on your returns, just to break even with keeping your money parked in a fund. If the gains are going to be taxed at a marginal rate of 25%, and you're managing to make returns of 11%, then after taxes your gains are actually only 8.25%. That's less than the 9.5% average gains of the NASDAQ. You would actually need to get returns of 12.7% just to break even with leaving your money alone. As your investments grow, it gets even harder to beat the market because the larger gains push you into a higher tax bracket. At the 35% bracket you have to achieve gains of 14.6% just to break even. Granted, you could limit this market timing to tax-advantaged accounts, but that will become a smaller and smaller percentage of your total investments if you keep increasing your contributions. The smaller fraction of tax-advantaged funds will matter less and less over time. Plus, refer back to the first reason, or risk watching your tax-advantaged retirement accounts dwindle instead of grow.

Third, if you stick to index funds, as you should, you are limited in how soon you can sell after buying a fund. Depending on how you're investing, this limit can be 30 to 90 days from your last contribution. This limitation makes timing the market all the more difficult and fraught with risk. But that's a feature, not a bug. It discourages trying to do something you just shouldn't do. If you really want to try being a day trader, you're going to have to go with individual stocks, and that path carries its own set of bigger risks and an even bigger time commitment. Besides, look at those graphs of our investments. Nearly all of the downturns in the market were in the noise, save the dotcom crash and the Great Recession, and the latter doesn't even look like that big of a deal in the graph considering the recovery afterward. The bottom line is, you shouldn't sell. That is, unless you're ready to sell.

The one case where it's probably okay to sell early is if we've already overshot our long-term goals. Take a look back at the last graph. At the peak of the dotcom boom, before the bust, the model is showing investments of nearly $13.7M in the 29th year. If our goal was $10M or less by retirement, then it would be perfectly fine to sell off a significant amount of that position, pay the taxes on the long-term gains, and sink it into a more stable investment for safe-keeping. Or we may even decide to retire early! When the market crashes and the index fund is cheap again, we may even decide to get back in and benefit from the recovery. The point is that selling to get out of the market and then buying later to get back in had nothing to do with trying to predict the dotcom boom and bust. We were simply acting on the fact that our goals were met, and then we saw a prime opportunity that we couldn't pass up. Suffice it to say, these situations don't come up very often. In this 48-year span it only happened once, arguably twice with the housing crash, so it should not be a strategy to depend on happening frequently.

We've learned a great deal from this set of simple models. It's surprising how little code is needed to get a clear picture of some solid investment strategies. It's so obvious that it's great to start early and let the wonders of exponential growth work for you. Investing often—at least once a year—makes a huge difference in the value of your nest egg. Continuing to increase the contributions over time also maximizes your savings potential, and even adds significantly to the accumulated savings in later years. The best part is how easy it is to experiment once we have a working model. We can twiddle with the parameters and see how changes affect the outcome. Through that experimentation, we can get more comfortable with why certain recommendations make good sense, and better understand which investment strategy will help us reach our retirement goals with minimal fuss.

Ep 26: Big Fun With Little Figures Is Live!

Ep 26: Big Fun with Little Figures

I talk with Howard Whitehouse about Mad Dogs With Guns, his gangster game from Osprey Games. In a separate segment, I talk with Peter Berry of Baccus 6mm to talk about the seeming monopoly of 28mm figures and games in the glossy gaming magazines.

https://soundcloud.com/user-989538417/episode-26-big-fun-with-little-figures

The Veteran Wargamer is brought to you by Kings Hobbies and Games

http://www.Kingshobbiesandgames.com

https://www.facebook.com/Special-Artizan-Service-Miniatures-1791793644366746/

Join the conversation at https://theveteranwargamer.blogspot.com, email theveteranwargamer@gmail.com, Twitter @veteranwargamer

Segment 1

Follow Howard on Facebook

https://www.facebook.com/Howard.Whitehouse.Writer/?ref=br_rs

https://www.facebook.com/Pulp-Action-Library-283960595046814/

Buy Mad Dogs With Guns:

Mad Dogs With Guns - Howard Whitehouse https://ospreypublishing.com/mad-dogs-with-guns

Pulp Action Library - http://www.pulpactionlibrary.com/

Other companies we mentioned:

Copplestone Castings http://www.copplestonecastings.co.uk/list.php?cat=7

Pulp Figures https://pulpfigures.com/products/category/11

Brigade Games http://brigadegames.3dcartstores.com/

Paddy Whacked - T.J. English https://www.amazon.com/Paddy-Whacked-Untold-American-Gangster/dp/0060590033

The Outfit - Gus Russo https://www.amazon.com/Outfit-Gus-Russo/dp/1582342792/

True Detective - Nathan Heller Series - Max Allen Collins https://www.amazon.com/True-Detective-Nathan-Heller-Novels/

Segment 2

Follow Baccus6mm on Facebook - https://www.facebook.com/Baccus6mm/

Joy of Six - https://www.facebook.com/TheJoyofSix/

Peter's Opinion piece - https://www.baccus6mm.com/news/20-09-2017/Historicalgaming-'Thetimestheyareachanging'/

Other companies we mentioned:

Warlord - https://us-store.warlordgames.com/

Perry Miniatures - https://www.perry-miniatures.com/

Games Workshop - https://www.games-workshop.com/en-US/Home

Wargames, Soldiers and Strategy - https://www.karwansaraypublishers.com/wss-mag

Music courtesy bensound.com. Recorded with zencastr.com. Edited with Audacity. Make your town beautiful; get a haircut.

I talk with Howard Whitehouse about Mad Dogs With Guns, his gangster game from Osprey Games. In a separate segment, I talk with Peter Berry of Baccus 6mm to talk about the seeming monopoly of 28mm figures and games in the glossy gaming magazines.

https://soundcloud.com/user-989538417/episode-26-big-fun-with-little-figures

The Veteran Wargamer is brought to you by Kings Hobbies and Games

http://www.Kingshobbiesandgames.com

https://www.facebook.com/Special-Artizan-Service-Miniatures-1791793644366746/

Join the conversation at https://theveteranwargamer.blogspot.com, email theveteranwargamer@gmail.com, Twitter @veteranwargamer

Segment 1

Follow Howard on Facebook

https://www.facebook.com/Howard.Whitehouse.Writer/?ref=br_rs

https://www.facebook.com/Pulp-Action-Library-283960595046814/

Buy Mad Dogs With Guns:

Mad Dogs With Guns - Howard Whitehouse https://ospreypublishing.com/mad-dogs-with-guns

Pulp Action Library - http://www.pulpactionlibrary.com/

Other companies we mentioned:

Copplestone Castings http://www.copplestonecastings.co.uk/list.php?cat=7

Pulp Figures https://pulpfigures.com/products/category/11

Brigade Games http://brigadegames.3dcartstores.com/

Paddy Whacked - T.J. English https://www.amazon.com/Paddy-Whacked-Untold-American-Gangster/dp/0060590033

The Outfit - Gus Russo https://www.amazon.com/Outfit-Gus-Russo/dp/1582342792/

True Detective - Nathan Heller Series - Max Allen Collins https://www.amazon.com/True-Detective-Nathan-Heller-Novels/

Segment 2

Follow Baccus6mm on Facebook - https://www.facebook.com/Baccus6mm/

Joy of Six - https://www.facebook.com/TheJoyofSix/

Peter's Opinion piece - https://www.baccus6mm.com/news/20-09-2017/Historicalgaming-'Thetimestheyareachanging'/

Other companies we mentioned:

Warlord - https://us-store.warlordgames.com/

Perry Miniatures - https://www.perry-miniatures.com/

Games Workshop - https://www.games-workshop.com/en-US/Home

Wargames, Soldiers and Strategy - https://www.karwansaraypublishers.com/wss-mag

Music courtesy bensound.com. Recorded with zencastr.com. Edited with Audacity. Make your town beautiful; get a haircut.

Mini Militia MOD Apk – Pro Pack, Unlimited Ammo, Ulimited Health

Doodle Army 2: Mini Militia MOD is a free-to-play 2D shooter game released for iOS and Android devices. Maximize your fun by adding some Mini Militia MODs to your game! Like Unlimited Health, Unlimited bullets, Unlimited Flying, One shot kill, the etc.this game is everyone favorite so why not to combine all the mods available for it into one and share with you guys this is what we did today so without wasting time lets get started

Mini-Militia is so popular nowadays! It is simple & easy to play. But what about adding a bit more fun by using Mini Militia MOD APK & Mini Militia Cheats! I've researched a lot & finally collected 3 Mini Militia Latest MOD APK for Android! Direct Download via Google Drive Links!

Disclaimer: All the mods and hacks are just for trial purpose. This is only to show the hidden features of the mini-militia. If you like the features, then you can purchase the pro pack and enjoy playing the features legally. While the mini militia health hack is not there, but you can increase the capacity of health. If you can purchase then cooperate with developers and purchase it. We are not responsible for any disruption. File Links shared here are total responsibility for their hosted site.

Mini-Militia MOD Apk:

NOTE: All MODs here are for educational and trial purposes only! And never use it for your advantage. It's just for fun.Mini Militia MOD APK Pro Pack Latest Version:

It is for those who don't want to use mini militia hacks but want to get access to all weapons to win more! This Mini Militia MOD APK 2018 latest version is best for fair play.

Features:

- Pro Pack Unlocked Free

- Latest Version 4.0.36 MOD APK

- Pre-added Points in the shop

2. Mini-Militia MOD APK Unlimited Ammo and Nitro

It has some basic cheats/hacks. It has pro pack, unlimited flying, ammo without reload and Unlimited x7 Zoom for any gun! Mini Militia MOD shd is suitable for those who don't want to show that they are cheating or using Mini Milita MOD app 2018.

Features:

- Pro Pack Unlocked Free

- Unlimited Flying/Nitro

- Unlimited Ammo/bullets

- No reload

- Spawn with New Heavy Gun

- 7x Zoom on any gun

3. Mini Militia ALL MOD APK – MEGA MOD!

It has Mini Militia all MODs such as free pro pack, unlimited health, unlimited nitro, unlimited ammo, unlimited flying & Mini Militia one shot kill hack. Fully Hacked Mini Militia APK. Mini Militia Unlimited All MOD Everything unlocked & no dying! You'll not die in this GOD MOD. Including Mini Militia two guns

FEATURES:

- Unlimited Health

- Unlimited Ammo

- Unlimited Flying/Nitro

- Unlimited Points

- One shot kill

- Multiple bullets per shot

- No reload

- Custom Avatar

- Two Guns at once

4. MEGA MOD v3.0.87 (No Infinite Health)

MOD Features- Unlimites Ammo

- Unlimited Flying

- Unlimited Battle Points

- One Shot Kill

- Pro Pack Unlocked

5.Doodle army 2 MEGA MOD: Pro

MOD Features:- Pro Pack Unlocked

- Unlimited Health Unlimited Ammo

- Unlimited Flying

- Red Aim for Better Accuracy

- Anti-Ban

6. Ultra MOD Pack! (with Invisible Avatar)

MOD Features:- Unlimited Nitro

- Unlimited Ammo

- Health One Shot Kill

- Invisible Avatar

- Pro Pack Activated Already

- Dual Weild Any Gun

So, That's it guys! I hope you will like these MODs! Don't forget to Share this Post with your friends to help them out to get the Unlimited Fun!

AdSense Now Understands Telugu

Today, we're excited to announce the addition of Telugu, a language spoken by over 70 million in India and many other countries around the world, to the family of AdSense supported languages. With this launch, publishers can now monetize their Telugu content and advertisers can connect to a Telugu speaking audience with relevant ads.

To start monetizing your Telugu content website with Google AdSense:

Check the AdSense program policies and make sure your website is compliant.

Sign up for an AdSense account.

Add the AdSense code to start displaying relevant ads to your users.

Welcome to AdSense! Sign up now.

Posted by:

The AdSense Internationalization Team

To start monetizing your Telugu content website with Google AdSense:

Check the AdSense program policies and make sure your website is compliant.

Sign up for an AdSense account.

Add the AdSense code to start displaying relevant ads to your users.

Welcome to AdSense! Sign up now.

Posted by:

The AdSense Internationalization Team

Lord Of The Rings, Vol. II: The Two Towers: Summary And Rating

Lord of the Rings, Vol. II: The Two Towers

United States

Interplay (developer and publisher)

Released in 1992 for DOS, 1993 for FM Towns and PC-98

Date Started: 5 February 2019

Date Ended: 15 March 2019

Total Hours: 18

Difficulty: Easy (2/5)

Final Rating: (to come later)

Ranking at time of posting: (to come later)

Summary:

Difficulty: Easy (2/5)

Final Rating: (to come later)

Ranking at time of posting: (to come later)

Summary:

A shallower, smaller, shorter sequel to a superior predecessor, The Two Towers tells the second of Tolkien's three books from the perspective of three adventuring parties. While the top-down perspective and interface (recalling Ultima VI but with a bigger window) are both adequate, and the game follows its predecessor in offering a number of non-canonical NPCs and side-quests, it remains under-developed in RPG mechanics like combat, character development, and equipment. The switching between parties, over which the player has no control, is jarring, and by the end it feels like no party ever got any serious screen time.

*****

I'm not sure that it's possible to make a truly excellent RPG based on an existing plot with existing characters, particularly ones who live as largely in the imagination as the canonical members of the Fellowship of the Ring. This is different, you understand, than setting a new adventure in a familiar universe. If I had made a Lord of the Rings game, I would have told a story of a group of rangers, or Rohirrim, or even a motley group like the Fellowship, engaged in a struggle ancillary to the main plot, perhaps featuring Frodo, Aragorn, et. al. as NPCs. Games based on Dungeons & Dragons' Forgotten Realms largely seem to take this approach, although with much less well-known source material.

|

| Offering an option to execute Gollum took some guts. |

The problem with using existing plots is that either the player is on a railroad towards a predetermined destination, or he's jarred by the detours. Perhaps the only way to do it well is to allow such detours (as Interplay did here) and then give it to a player who doesn't care much about the original (e.g., me). In that sense, the game world worked out very well. Before we get into a litany of complaints, we have to at least admire the flexibility of the plot, plus the game's ability to introduce side quests that work thematically with the main plot points. It was a strength of Vol. I as well.

The game fails, on the other hand, in just about every possible way as an RPG. There is no experience or leveling. Character development occurs through the occasional increase in attributes and the occasional acquisition of skills as a reward for exploration or quest-solving. None of these improvements mean anything because, first, combat is so easy that your characters don't need to improve to beat the game, and second, every party starts with all the skills they need spread out among the characters. Inventory upgrades are scarce and essentially unnecessary for the same reasons. Combat couldn't be more boring, and there's essentially no magic system: "spells" are keywords that solve puzzles, more like inventory items.

|

| Very late in the game, Aragorn can learn skills he won't need for the rest of the game. |

Even worse is the way that it undercuts nonlinear exploration and optional encounters, essentially its only strength. While many of the side-quests and chance encounters are interesting, hardly any of them offer anything material to the characters. In fact, every time you stop to check out an unexplored area or building, you run the risk of some extra combats that leave the party weakened for the required encounters. This is related to the game's absurd healing system, by which characters are only fully healed at a few plot intervals, with meals and Athelas curing just a few hit points in between.

Now, it turns out that I missed a lot of side quests, mostly towards the end. The open world is nice, but the game only gives you any directions along the main quest path. I never returned to Dunland, and thus missed the side adventures there. Ithilien had at least three side quests that Frodo and his party didn't do, including a crypt, a Haradrim deserter who will join the party, and recovering the eye of the statue. If I'd gone another way in the Morgul Vale, I would have met Radagast. Aragorn missed the entire "Glittering Caves" sub-area, which culminated in a fight with a dragon and would have given him some powerful gloves. I still don't know what I did wrong here. I did find the way to the Glittering Caves, but I somehow missed the transition to the multiple levels that the hint guide says exist. I guess I was supposed to return after the Battle of Helm's Deep, but that would have meant embarking on a lengthy side-quest while on the threshold of victory for the game at large.

|

| I'm not sure how I was supposed to get past this. |

It's also possible that I missed some of these side quests because of another problem: the interface. There are parts that aren't so bad. The top-down perspective, the commands, and the auto-map all basically work, and I like the way you can make the interface go away and use the full screen for just exploration. What sucks is the approach to triggering encounters. You don't see an NPC or group of enemies in the corner of your exploration window. No, they just suddenly pop up because you've happened to walk on the right set of pixels or brushed up against the right object. There's very little correspondence between visual cues on screen and the appearance of encounter options. Sometimes, you see chests but walking up to them and bumping into them does nothing. Other times, you're in a blank room, and you're told about items and people that aren't on the screen at all.

|

| Note that there are no orcs anywhere on this screen. |

Finally, we have the matter of pacing. It's like the game itself has no idea what's going to come next. The battle of Helm's Deep involves six combats in a row, in two sets of three, with only a little bit of healing offered between the sets. After this epic battle, the party can rest and get fully healed, then (apparently) go off and find some magic gauntlets, when there's only one more (easy) combat remaining in the game. On Frodo and Sam's side, late in the game they have to figure out how to cut through Shelob's web. The option I chose (use the Star Ruby) causes the hobbits to get burned a little bit, which would suck--except that the endgame happens five seconds later. Why bother to attach a penalty to the choice?

And while we're talking about pacing, it's important to remember how all the erratic cutting between parties makes it hard to keep track of what any one party is doing. I completely missed an opportunity to recover Anduril because the game lurched to a different party when I was on that quest, and by the time it took me back to Aragorn, it was shouting that Helm's Deep was nigh.

|

| Making the least-optimal choice hardly matters when the game is over at the next intersection. |

Lord of the Rings, Vol. I had a lot of these problems (except the last one), and it ended up with a relatively-high 49 on the GIMLET. Before we rate this one, it's worth thinking about some of the differences. One is size. Vol. I is quite a bit bigger. Although Vol. II is good in this regard, Vol. I offered more opportunities for side quests, inventory acquisition, character development, healing, and general exploration. Pacing issues were caused as much by the player as by the plot.

Vol. I gave you a lot less direction on what to do next. There was a general sense that you had to keep moving east, but you weren't constantly getting title cards explicitly explaining the next step of the quest. For that reason, NPCs and the dialogue system took on a much greater importance. Here, although you can feed NPCs a variety of keywords, they mostly just tell you what the game has already told you in long paragraphs. You never really need them for any clues.

NPCs themselves were more memorable. They had personalities, agendas, side quests, and even a couple of betrayals. Vol. II only marginally developed any of that. There was a poor economy in Vol. I, but Vol. II had no place to spend money at all despite showing that the characters had it. Also keenly felt is the loss of nice graphical (or animated, in the remake) cut scenes between major areas.

Both games do reasonably well in the area of encounters. I've always liked the way Interplay games (including Wasteland and Dragon Wars) require you to read clues and then figure out the right skills to directly employ. Sometimes, items can substitute for skills. But Vol. I's encounters of this nature were less obvious and a little less generous in the variety of things that would work. You couldn't ignore options to improve skills or acquire quest objects. In Vol. II, you can pretty much just walk from beginning to end, knowing that your starting characters have whatever they need.

The rest might just be a matter of bad memory. Recalling the first game, I feel like the graphics offered a little more detail, that encounters didn't depend on hitting quite such a small set of pixels, that there was a little more character development, a slightly better inventory system, and so forth.

|

| The game tries to evoke the majesty of Middle Earth without showing much. |

Let's see how they compare:

1. Game world. The Two Towers definitely makes good use of the Middle Earth setting. The backstory and lore section of the manual are thorough and interesting. It wasn't until I read it that I finally understood some allusions from the films and the previous game, such as what "Numenor" refers to and what Gandalf actually is. While the game doesn't do a lot to build on this setting, it certainly is in keeping with it. Score: 6.

2. Character creation and development. There's no creation at all and only the slightest, near-invisible development. You mostly forget that the attributes even exist. Aragorn started with 70 dexterity, 28 strength, 33 endurance 75 luck, and 75 willpower, and he ended with 74, 28, 38, 79, and 77. Clearly, some development occurred, but never was I notified of any of these increases, and I really have no idea what caused them. The skills system would get more points if the game was a bit more balanced in how you acquire and use them. Score: 2.

3. NPC interaction. I always enjoy keyword-based dialogue systems, but here it's mostly purposeless. When a title card has just told you that "Orcs have ravaged this village and its people are forlorn," you don't need six different NPCs saying, "Orcs destroyed us!" and "We have lost hope!" I did like the few NPCs who could join the parties. Without them, the game would have been forced to either avoid combat with the hobbit parties or make the hobbits uncharacteristically effective. Score: 5.

|

| I'm sorry we didn't see more of Eowen. |

4. Encounters and foes. Despite Tolkien featuring a large bestiary, you only really ever fight orcs and men in this game (aside from a few one-off battles). The only points I give here are for the non-combat encounters, which are frequent, require some puzzle-solving skill, and offer some role-playing opportunities. As mentioned, I don't like the way that they appear, but that's more of an interface issue. Score: 5.

5. Magic and combat. Combat features no tactics, no magic, no items to use. Just "attack" and select your preferred foe from a menu. The "magic system," as such, is just the acquisition of some spell keywords that occasionally solve puzzles, but I only had to use one of these words once. (This is in contrast to the first game, where they were constantly required.) Score: 1.

|

| The easy, boring combat system. |

6. Equipment. I found a few upgrades throughout the game: leather to chain, chain to magic armor, sword to magic sword, and so forth. It just didn't feel like any of it did anything. Most of the items that burdened my inventory were quest items, and I found no use for a lot of them. Score: 2.

7. Economy. In contrast to the first game, there is none. The game keeps track of a "silver" statistic for each character for no reason. Score: 0.

8. Quests. Perhaps the strongest point. Each party has a clear set of main quests, an equal number of side quests, and even a few options about how to complete them. I enjoyed the side quests most because with them, I was exploring Middle Earth rather than just hitting a series of determined locations and plot points in a row. Score: 5.

9. Graphics, sound, and interface. The graphics aren't objectively bad, but I do think they fail to live up to the player's imagination of storied places like Helm's Deep and Minas Morgul. The failure to show so many things that the game tells you is also pretty stark. Sounds are mostly beeps and the occasional "oof" in combat.

|

| The staircase to Cirith Ungol hardly seems hidden, tight, steep, or foreboding, especially with the silly "mountains" on either side. |

There are aspects of the interface that work well. The size of the game window seems practically luxurious, and you have to wonder if Ultima VII took a lesson from this game or its precursor. The automap works pretty well. There are some nice touches like the star that appears next to the most recently-saved game when you go to load a game. I definitely appreciated the use of keyboard commands for most major actions, in addition to the buttons. Overall, the game would earn a high score in this category except for the encounter-triggering issue, which is both a graphical problem and an interface problem, and comes close to ruining the game on its own. Score: 4.

10. Gameplay. Vol. II is a bit more linear than Vol. I, but not compared to other games. I suspect that Frodo and Sam could have turned around in the last chapter, left the Morgul Vale, and walked all the way back to the Dead Marshes, cleaning up side quests along the way. The nonlinearity coupled with the side quests lend a certain replayability--in fact, I think the game would probably improve on a replay, with a better understanding of the pacing and terrain.

I found it far easier than its predecessor, as exemplified by the battle in which Frodo killed the vampire. I was supposed to solve that with a quest item. The game should have made combats harder and the healing system less erratic. Finally, it's also a bit too short, particularly with the action split among three parties. I suspect you could win in a speed run of just an hour or so. Maybe I'll try when I get some more free time. Score: 4.

That gives us a final score of 34, as I suspected quite a bit below Vol. I and even below my "recommended" threshold, though just barely. The engine was a bit better than the game itself, and was used in a superior way in the first title. This one seemed a bit rushed and perfunctory.

|

| I did like some of the "instant deaths." |

Computer Gaming World disagreed with me on the first game by largely hating it: reviewer Charles Ardai obsessed about divergences from the books and didn't even seem to notice the more revolutionary elements of the interface. He dismissed it as "not special enough to carry the Tolkien name." But in the October 1992 issue, reviewer Allen Greenberg gave a much more positive review of the sequel. In particular, he addressed the carping of people like Ardai by pointing out that Middle Earth had taken on a certain life of its own, and if we can forgive Tolkien himself for his many appendices and allusions, why complain about a few side-quests and side-characters in a game that's otherwise relatively faithful to the material?

Greenberg also offers a relatively nuanced discussion of the party-switching system, pointing out (correctly) that the very approach is revolutionary, and while Interplay might have refined the approach ("Interplay may wish to consider allowing the player at least a vote in the decision making process as to whether it is time to switch locations"), the innovative system offered a "depth of narrative which would not otherwise have been possible." Greenberg's comments led me to avoid subtracting points for this element despite complaining about it several times.

MobyGames catalog of reviews for the game has them averaging in the high 50s, which is pretty miserable. On the other hand, the lack of any seriously rabid fan base must have softened the blow when Vol. III was never released. A couple of years ago, Jimmy Maher published an excellent entry on what was happening with Interplay during this period. The summary is that the company was struggling as a developer/publisher, with Dragon Wars not having sold well in a crowded RPG market. Founder Brian Fargo managed to secure the rights the trilogy from Tolkien Enterprises, figuring that the Lord of the Rings name would make the games stand out among their competitors.

Interplay was already in the midst of a new RPG called Secrets of the Magi that would feature a free-scrolling interface. Fargo pulled the team off that project and put them to work on Lord of the Rings. By the time the game was released, the company had been badly hurt by the collapse of Mediagenic, publisher of Interplay's Nintendo titles. Interplay rushed production to make the Christmas 1990 buying season. They ended up releasing the game with a lot of bugs and cut features (including an automap), missed the Christmas season anyway, and got lukewarm reviews.

The company was saved by the unexpected success of a strategy game called Castles. Now understanding that the Tolkien name alone didn't ensure success in sales, Vol. II was produced with a smaller staff. When it, too, got poor reviews, and when repackaging Vol. I on CD-ROM also failed to generate significant sales, there was no impetus to move on to Vol. III. Some sites claim that before it gave up on III, there had been plays to turn it into more of a strategy game.

|

| ". . . no one." |

Maher memorably concludes:

Unlike Dragon Wars, which despite its initial disappointing commercial performance has gone on to attain a cult-classic status among hardcore CRPG fans, the reputations of the two Interplay Lord of the Rings games have never been rehabilitated. Indeed, to a large extent the games have simply been forgotten, bizarre though that situation reads given their lineage in terms of both license and developer. Being neither truly, comprehensively bad games nor truly good ones, they fall into a middle ground of unmemorable mediocrity. In response to their poor reception by a changing marketplace, Interplay would all but abandon CRPGs for the next several years.

Indeed, the next RPG we'll see from Interplay isn't until 1995 (Stonekeep), followed by two in 1997: Fallout and Descent to Undermountain. It's hard not to see a little of the Lord of the Rings interface in Fallout's: axonometric graphics, continuous movement, a large main game window, and commands hosted in a set of unobtrusive icons with keyboard backup. (Vol. II and Fallout even share at least one designer, Scott Bennie.) Fallout shares these characteristics with the Infinity Engine, which was developed by Bioware but with a close relationship with (and financing from) Interplay. I'm probably grasping at straws, but I look forward to exploring the engines' history more when we get to those games.

The Two Towers was the last attempt to make an official Middle Earth game until after the Peter Jackson film series, which spawned a host of new games that, like the films themselves, are controversial among fans. (We won't see another one until 2002's The Lord of the Rings: The Fellowship of the Ring.) The 1990s were the only era in which Tolkien fans were likely to get an RPG that was technologically and graphically advanced enough to be fun, but not yet influenced ("tainted," as I'm sure some would have it) by the films. While the two Interplay titles have some promise and fun moments, it's too bad that they were the only attempts.

****

While we're wrapping things up, I think I might be ready to throw in the towel on The Seventh Link. I hate to do it, particularly when I know the developer is reading, but I can't seem to force myself to map and explore all the large dungeon levels. I'll chew on it for another couple days while I get started with Star Control II.

Thursday 28 March 2019

Link Roundup

Hey all, I haven't been using this blog for much, so I figured I'd use at least to point you at other things I've done recently (and give a somewhat permanent record to them).

I made my front-page debut at The AV Club with this piece about the problems networks have with superhero shows. This was a fairly difficult piece to wrangle, but after putting up with No Ordinary Family and The Cape last year, it was pretty inevitable.

I've continued reviewing the middling but still potentially good Terra Nova there, along with the usually-charming, always-slight American Dad. More excitingly, my TV Club Classic reviews of Veronica Mars are back.

I also reviewed Neal Stephenson's Reamde, which both a very good book and an exciting opportunity for me to review a book from the King of All Nerds at a major website.

This review of Might & Magic Heroes VI may be my last game review at the AV Club for a while - there's lots of people who want to review games there, and...

...I've also started doing game reviews at Paste Magazine, including this one of Bit.Trip.Complete and this one of Red Orchestra II. I'm quite happen with both of them, as the editorial freedom there and longer word count gave me the opportunity to really delve into what made each of the games interesting.

I made my front-page debut at The AV Club with this piece about the problems networks have with superhero shows. This was a fairly difficult piece to wrangle, but after putting up with No Ordinary Family and The Cape last year, it was pretty inevitable.

I've continued reviewing the middling but still potentially good Terra Nova there, along with the usually-charming, always-slight American Dad. More excitingly, my TV Club Classic reviews of Veronica Mars are back.

I also reviewed Neal Stephenson's Reamde, which both a very good book and an exciting opportunity for me to review a book from the King of All Nerds at a major website.

This review of Might & Magic Heroes VI may be my last game review at the AV Club for a while - there's lots of people who want to review games there, and...

...I've also started doing game reviews at Paste Magazine, including this one of Bit.Trip.Complete and this one of Red Orchestra II. I'm quite happen with both of them, as the editorial freedom there and longer word count gave me the opportunity to really delve into what made each of the games interesting.

Subscribe to:

Posts (Atom)